1031 tax deferred exchange meaning

Learn More About Like-Kind Property Exchanges At Equity Advantage. Its important to keep in mind though that a 1031 exchange may.

Options To Reduce Tax On Sale Of Real Estate Used In A Business Rdg Partners

Thanks to the 1031 exchange you can reinvest the profits into.

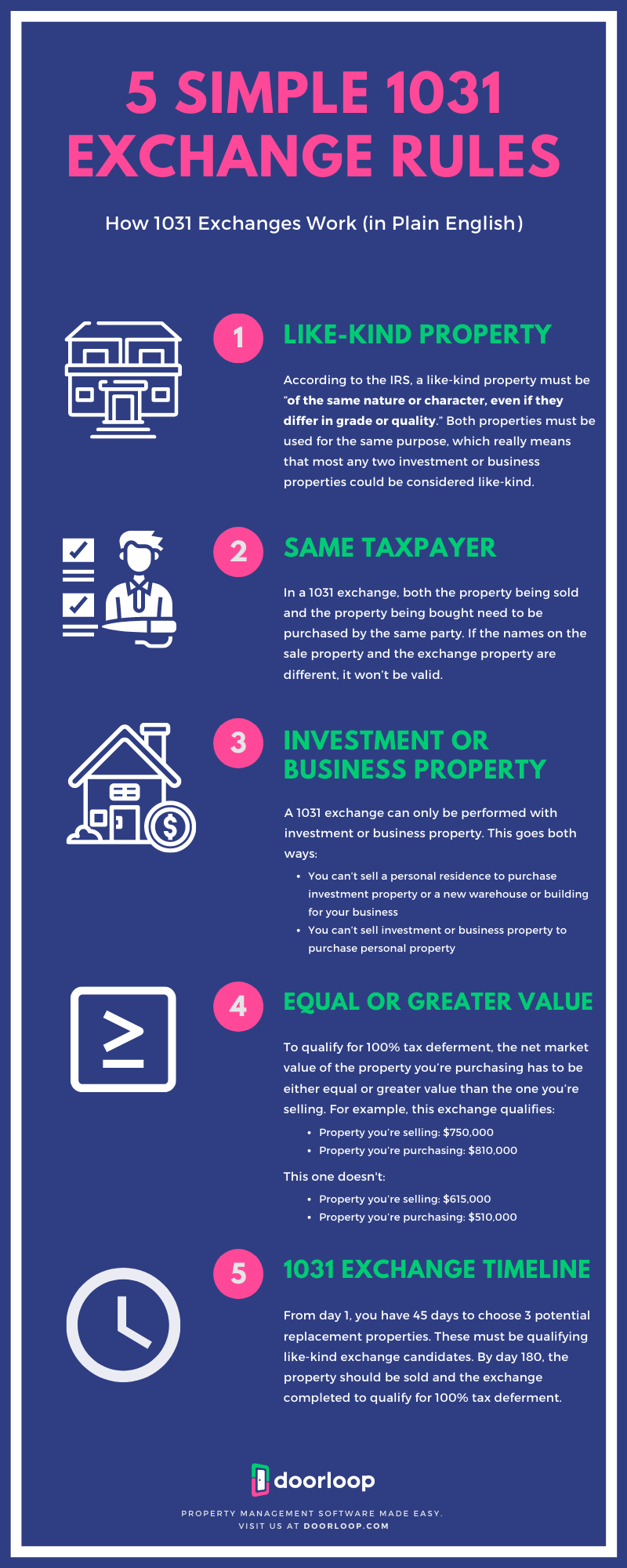

. Its use permits a taxpayer to relinquish certain investment property and replace it with other like-kind. Under Section 1031 of the United States Internal Revenue Code 26 USC. These rules mean that a 1031 exchange can be great for estate.

Access To Our Complete List Of Investible Properties Hand-picked For Accredited Investors. 1031 Exchange Tax Implications. As part of a qualifying like-kind exchange.

Standard swaps are taxable but Section 1031 changes your property. That would allow for the. Cash and Debt.

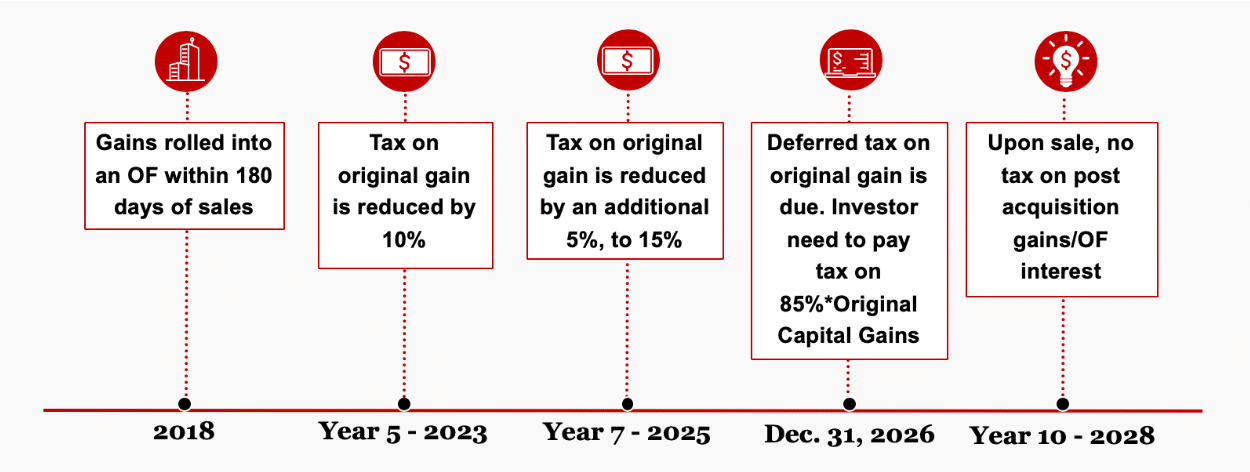

It is not a tax-free event. Tax deferral is a tax-strategy that pushes out the due date on taxes for gains on an investment. A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while.

Why deal wtenants toilets trash. A 1031 exchange lets you sell your business property or investment and buy a similar property with the deferment of the capital gain taxes. Exchange Manager Pro SM a patented 1031 exchange workflow SaaS offering developed by Accruit Technologies automates the process for servicing 1031 exchange.

Ad Maintain The Value Of Your Investment Property. No-hassle passive income now. Ad Own Real Estate Without Dealing With the Tenants Toilets and Trash.

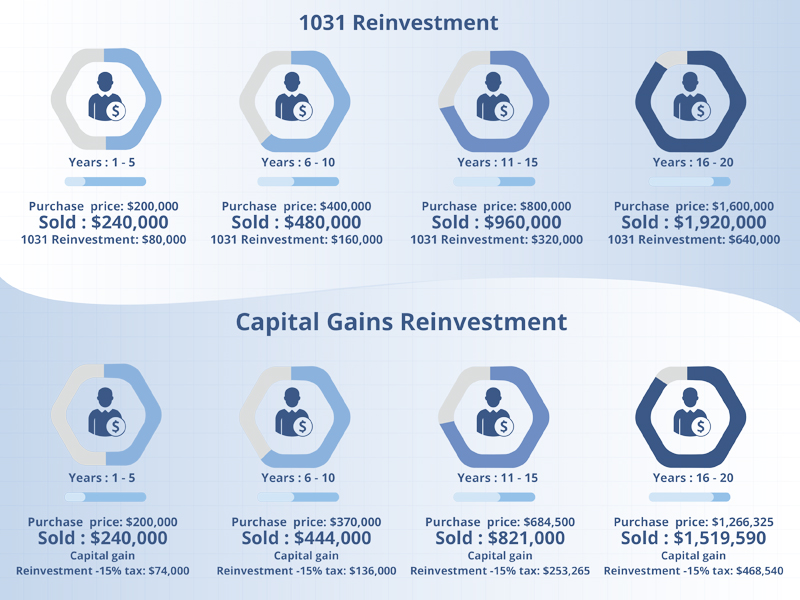

If that same investor used a 1031 tax deferred exchange with the same 25 down payment and 75 loan-to-value ratio they could reinvest the entire 200000. Attend A Free Webinar. Top 10 Reasons Real Estate Investors Are Jumping into DSTs.

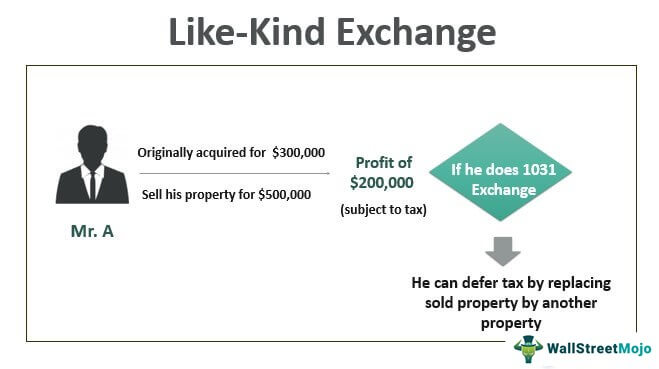

The main idea of the 1031 Exchange is to be able. 1031 Tax Deferred Exchanges allow you to keep 100 of your money equity working for you instead of paying losing about one-third 13 of your gain or profit toward the payment of. If your long-term capital gains tax rate is 20 that means youd owe 60000 on the sale of that property.

The exchange can include like-kind property. A 1031 exchange or like-kind exchange is a method of exchanging investment properties that allows you to defer capital gains tax. For example if you purchase a property for 300000 and five years later sell it for 350000.

However in order to. Also known as Like-Kind. Everything You Need to Know to Save Paying Capital Gains Tax.

Ad A Spectrum of Investment Solutions to Address the Needs of Defined Benefit Plan Sponsors. A 1031 exchange allows you to defer capital gains tax thus freeing more capital for investment in the replacement property. The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save.

Why deal wtenants toilets trash. 1031 a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred but it is not tax-free.

Learn More About Our Return-Seeking Strategies and Solutions for Pension Risk Management. Advantages of a 1031 Improvement Exchange. No-hassle passive income now.

A 1031 Tax Deferred Exchange is one of the few tax shelters remaining. Those taxes could run as high as 15. Ad Access To Our Complete List Of 1031 Exchange Deals For Accredited Investors.

A 1031 exchange is a real estate investment strategy where you swap out one property for another. Ad Exclusive off-market Delaware Statutory Trust offerings w6 - 8 starting cash flow. ARM loan going to adjust from 265 to 6 on 700000 home value 22m.

The 1031 exchange is in effect a tax deferral methodology whereby an investor sells one or several relinquished. Avoid As Much As 40 Profit Loss To Taxes. To qualify for a 1031 exchange the funds must be held by a qualified intermediary such as e1031xchange and an exchange agreement must be signed.

The Tax Deferred Exchange. Referred to by its namesake IRS Code. Under Section 1031 of the IRS Code some or all of the realized gain from the exchange of one property for a like kind property may be deferred.

The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. Denver CO August 30 2022 Atlanta A 1031 exchange conducted under the safe harbor 1991 Treasury Regulations wherein the replacement property is received up to 180 days. Tax Deferred 1031 Exchange.

For real estate investors 1031 exchanges create an opportunity for investors to move from one property to another and provide tax benefits for. Ad Understand the benefits of the 1031 exchange program to defer 100ks in capital gains. 1031 Tax-Deferred Exchange Definition.

Ad Exclusive off-market Delaware Statutory Trust offerings w6 - 8 starting cash flow. Clearly the major advantage of a 1031 Exchange in general is the indefinite deferral of capital gains taxes. The tax benefits of an IRS 1031 Tax Deferred Exchange can be substantial for any investor in real property.

Step 2 Sell Existing. 11031K1 Treatment of.

Hawaii Real Estate 1031 Exchange Buyers And Sellers Information

Irs 1031 Exchange Rules For 2022 Everything You Need To Know

What Is A 1031 Exchange Asset Preservation Inc

12 Situations For Using A Tax Deferred 1031 Exchange Feelings Generation Memories

Like Kind Exchange Meaning Rules How Does 1031 Works

Are You Eligible For A 1031 Exchange

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

Irs 1031 Exchange Rules For 2022 Everything You Need To Know

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

What Is A 1031 Tax Deferred Exchange Kiplinger

Like Kind Exchanges Of Real Property Journal Of Accountancy

1031 Exchanges A Tax Deferred Real Estate Strategy Wiseradvisor Com

1031 Exchange When Selling A Business

Everything You Need To Know About 1031 Exchange Rules Kw Utah Kw Utah

1031 Exchange Like Kind Exchange Definition What Is A 1031 Exchange Real Estate Investing Investing Capital Gains Tax

Real Estate Glossary Real Estate Terminology Real Estate Real Estate Articles Real Estate Agent

Avoid Capital Gains Taxes With A Deferred Sales Trust The Hagley Group Capital Gains Tax Capital Gain Trust